design, illustrations, and photos: Teresa Christian

It’s spring 2020, and eighth grader Dancan Mutai sits scrolling on his social media, looking for something to spend his endless time doing, when a TikTok about reselling sneakers shows up on his feed. He clicks on the profile of the person who posted the video to learn more.

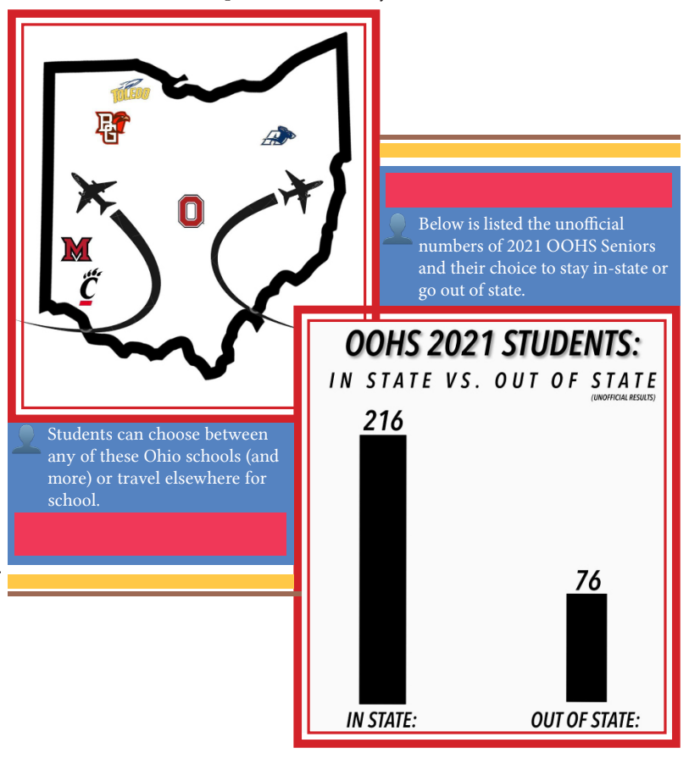

As entrepreneurship among youth begins to flourish, many high school students are becoming entrepreneurs. According to Business Teacher Teresa Gellenbeck, an entrepreneur is “anyone who has the passion and drive to pursue an idea and start a business to obtain a profit.” And for students like Mutai, this definition meets the mark.

Now in 2022, Mutai (now a junior) runs a shoe dropping business, which means he buys and resells sneakers. Mutai’s business wasn’t just a spontaneous decision though; he was already interested in reselling shoes when the pandemic struck, and with all of the extra free time, Mutai decided to take his chance.

“In quarantine, I didn’t have much to do, and I was scrolling through social media and saw a lot of videos of sneaker conventions. I was already interested in sneakers, so I sold my first pair of shoes that I got for Christmas and got about $200 and that’s how it started,” Mutai said.

For two years now, Mutai has continued to successfully run his business. Though successful, it’s not at all obstacle free.

“The biggest obstacle has been taxes because I have to keep track of all of my sales and every single shoe I get. I have to record all of that in spreadsheets, so tracking that, but in the beginning that wasn’t a big problem though,” Mutai said.

The process for becoming an entrepreneur like Mutai can be challenging but simple if students are willing to take the risk, according to Gellenbeck.

“It is risky because you’re risking your money for sure, if you invest money. Also, your time because you could pour all your heart, passion, and soul into hours and hours and it could not work. The statistics do show that the majority of small businesses fail in the first five years, so the odds are kind of stacked against you. But, I feel if you know that going into it, you have an idea, and you have persistence and passion, then you can overcome those obstacles,” Gellenbeck said.

There are many great resources within the school to get started as a student entrepreneur.

“Definitely take entrepreneurship class and or marketing. In Junior/Senior Marketing, we actually run the school store business. With entrepreneurship, you focus more on starting your own business whereas marketing you’re running a business. So definitely taking classes in school, and seeing if it’s an interest for you, it would be a great starting point,” Gellenbeck said.

Senior Luke Border, another student entrepreneur, went through the process of becoming an entrepreneur like Mutai. Border, a part-time photographer, was already interested in photography.

“I’ve always enjoyed photography, and I saw a way to further develop that passion and also make some money so I decided to go for it,” Border said.

Border currently sells his portraits by charging a flat rate per portrait session. Border specializes in portraits but hopes to soon focus on sports photography.

“Right now, in terms of what I make a profit from, I sell mainly portraits, but I would love to venture more into the realm of sports photography,” Border said.

Unlike Mutai, Border hasn’t experienced many obstacles within his process of being an entrepreneur.

“I haven’t faced a lot of obstacles; things for me are still very much in the preliminary stage, and I’m taking them at a pace that is manageable for me,” Border said. “I do plan on growing soon, so obstacles will have to be dealt with.”

Though entrepreneurship can seem like a land of its own, it’s always been much more than selling something for profit. Entrepreneurship has in fact been part of history since before currency was created, according to Hive.org.

As the United States has evolved and changed, so has its currency. From the Shekel to online banking, the development of money is continuously improving.

As times change, so do humans’ needs. Originally, money was just needed for certain tasks and trading, but now, people’s lives revolve around it.

“Originally, you learned in history class that the way goods and services were traded was through bartering and that there was no money. But money was introduced about 5000 years ago in Mesopotamia,” Economics Teacher Christian Hipsher said.

Although the Shekel, the first currency, existed around the world starting in 650 B.C., in the United States, the first $1 bill didn’t come around until 1775. The first paper money that was issued by the government was called “demand notes”, also referred to as “greenbacks”.

“Money came about due to humans having the need to trade and to store value,” Social Studies Teacher Kevin Haynes said. Money didn’t just sprout out of nowhere; it came about for very particular reasons.

The main reason that money was needed, especially in the United States, was because the country needed to trade goods and services. This process was hard to do without bartering and figuring out how much of one item was worth compared to another.

“You can’t simply take half of a chicken that you grew on your farm and trade it for something specific that you need, because the other person might not need a half of a chicken. Instead of trading one good for another, it is more beneficial to sell that half of your chicken, receive the value from that chicken in the form of money, then use it to purchase the things that you need,” Haynes said.

Although this was hard to get used to, it was such a huge benefit for everyone around the world. People could now sell what they had in abundance instead of just letting what was unused rot away.

In 1834, the United States developed a new form of currency, just in time for the gold rush in early 1848. The name of this new currency was the Gold Standard, according to econlib.org.

“As far as U.S. currency goes, and in modern world currencies, for a long time it was backed by the Gold Standard meaning there was actually physical gold for the dollar bill that was out,” Hipsher said.

The Gold Standard lasted until World War I. While there were still some financial crises while the Gold Standard was used, it was still one of the most economically stable times in American history.

“In society now, there is no gold backed standard, which is why maybe we’ve seen a little more inflation. The goldback standard ended in 1971. Richard Nixon announced that we would no longer use the gold standard for currency, and you’ve seen inflation rise even more since then,” Hipsher said.

Inflation, in simple terms, is the rate of increase in prices of goods and services over a certain period of time. For example, if one bought something for $1 in 1922, that same item would now cost $29.92.

“Inflation, whether it be 20 years or 100 years, it’s always going to have an impact on your money. When you look at inflation, especially in the last year, we have seen those inflation rates increase,” Hipsher said.

As inflation continues to rise, especially after the pandemic, so do exchange rates from country to country. Exchange rates are the rate at which one currency will be exchanged for another currency.

“Each country has its own currency, and each one has its own value. While each country’s currency and the value of the currency is different, they are used in the same manner, which is to buy goods and services,” Haynes said.

Some examples of other countries’ currencies are the Euro, the Indian Rupee, the Mexican Peso and the Egyptian Pound. These currencies are just a few of many, and all of them deal with inflation.

When it comes to the value of these currencies compared to ours, “our currency is as practical as any other country on Earth. However, ours is usually worth more due to the economic power that the United States has, due to our size and success in entrepreneurship and business,” Haynes said.

Paper dollar bills are what most people think of money as. They think of it as a currency that the government regulates and can print more of at any time it is needed. There is no set currency for money. Money is simply anything people use to store value in.

“Money is anything you can use to store value to exchange for goods and services,” AP Economics Teacher Adam Hire said.

Crypto currency is a form of money that is just starting to take off. This newer currency is known as a form of digital money that people can buy into with paper money to hold the value of their current paper money.

“Think of [crypto currency] as digital gold. You would buy gold by taking your money and exchanging it for the gold. Is the gold still valuable—yes. If a dollar ceases to exist, someone would most likely accept gold as a means of payment,” Hire said.

Governments are starting to invest in this online currency more. Unlike crypto currency, governments do not have control over the value of paper money and how much is printed.

“Fiat is when the government says this is worth a dollar because we say so. Our Federal Reserve can print money whenever they want. However, every dollar becomes less and less valuable every time more money is printed,” Hire said.

A fiat is when the government makes a decree about how much something is worth, and it is not backed by any raw material. Governments are buying into crypto currency because eventually this source of money can run out, so there can’t be more money added to the set values.

“So other governments are saying that instead of us having to print more money and causing higher inflation, they are buying up Bitcoin and saying this is the basis of our income,” Hire said. “Bitcoin has a finite supply; there will only be 21 million ever.”

Bitcoin is categorized as a form of hard money. This means that the government cannot manipulate the value of this money and how much of it they own. They have no control over when the value is peaking or decreasing in value.

“We saw the all-time high for the value of bitcoin last November. Last November, Bitcoin peaked at around $61,000,” Hipsher said.

The value of Bitcoin has never stayed constant and has changed just like the value of money always does.

“Bitcoin is now around $20,000, so it has gone down 66 percent,” Hipsher said.

When a government starts buying into a currency source, its citizens follow. This newfound interest in the government of investing in crypto currency might have an effect on citizens causing them to invest in crypto.

“The concept of crypto currency trying to make this decentralized currency isn’t going to be affected by the government’s actions. However, especially with globalization the acts the government takes will probably always have an impact on whatever currency we are using as a society,” Hipsher said.

A fad is the concept of a short-lived enthusiasm for something. Citizens are trying to decide for themselves if crypto currency will just be one of these fads or will become more than that.

“I would not view it as anything more than a fad— although the same could be said about the internet so I could be wrong,” Hipsher said.

Scams occur through the online use of crypto currency that lead some people to believe that crypto currency’s fame will be short-lived.

“Right now, we see a lot of under the table occurrences leading to scams and the destabilization of these crypto currencies. It’s not a stable asset at least right now,” Hipsher said.

On the opposite side, some people like the use of crypto currency. They view that it is an easier system to use than paper money because the value of crypto currency can be transferred in seconds.

“Using crypto currency more is good. I like using it. It is way easier to use than regular paper money,” Hire said.

The government always tends to set fads for people and have a huge influence in what they invest in so if the government starts to move all of their money digitally citizens will most likely follow, but citizens will still choose for themselves where they want to store their money.

“Whatever people care about, wherever they want to store their value, is what money will look like in the future,” Hire said. “From the government’s perspective though, I bet it will be digital and not paper anymore.”

Crypto currency has become more popular as greater numbers of people start to use it. Whether people choose to trust crypto currency or not it is taking off in the world today.

The concept of money is significant to society, with value commonly changing, and is key to know about when running a business.